LAND VALUES

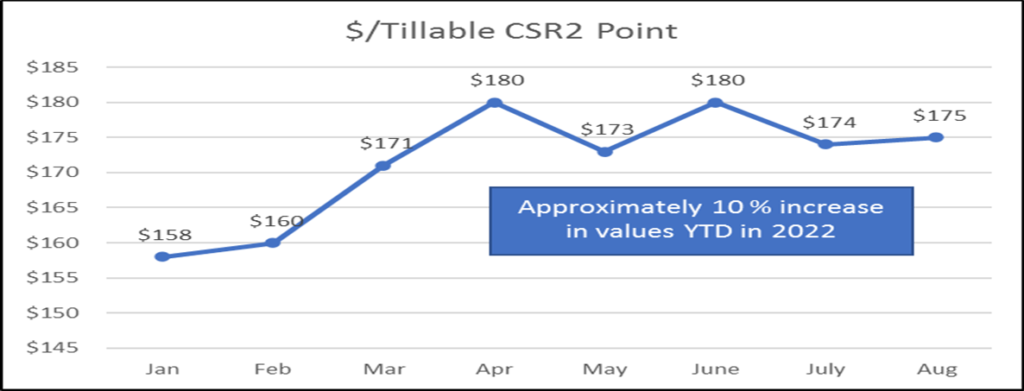

Similar to 2021, land values has continued to be the highlight of 2022. The graph below is from our internal comparable sales database that consists of 445 auctions or listings of farms with 70 % or higher tillable land across 73 counties in the state of Iowa.

The rating we calculate is $/Tillable CSR2 Point (CSR2 is a measurement of the productivity of the soil with 0 being the lowest and 100 being the highest), which allows for a trend to be identified regardless of the quality of the farm. As you can see, most of the increase occurred in about one month, which is when Russia invaded Ukraine and caused Corn & Soybean prices to increase rapidly.

BUILDING COSTS

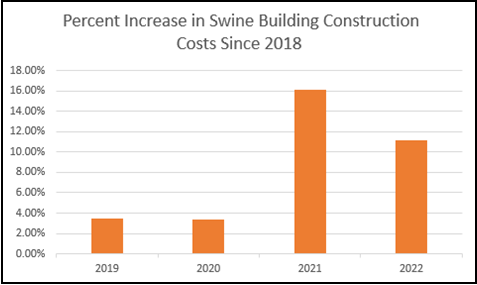

Another factor we closely track are construction costs. In particular, our company appraises many swine facilities across Iowa and across the nation. In the chart below we identify the percent increases in the cost to build a new swine building since 2018.

Overall, this is nearly a 40 % increase since 2018. The increases are apparent in other real estate sectors as well, which has reduced the amount of new construction. However, the impact on existing facilities has been a dichotomy: facilities that are the preferred design and in good condition have seen increases in value with many selling higher than it original cost to build them, while facilities that are in fair condition with an obsolete design have declined in values. One factor for the decline in value is the cost to remodel has increased as well, so a buyer factors this into their purchase price.

CROP CONDITIONS AND IMPACTS ON FARMS WE MANAGE

Nationally, crop prospects are a tail of two halves. The northeast half of the Cornbelt has received adequate precipitation while the southwest half is facing drought conditions in many areas. Recently the Pro Farmer crop tour indicated a drastically lower national corn yield for 2022, 168.1 bushels per acre, than the August USDA prediction of 175.4 bushels per acre.

Stronger commodity prices continue to provide tailwinds to cash lease rates as we look towards the 2023 crop year. December 2023 corn futures have been trading between $5.50 and $6.00 (equaling $5.20 to $5.50+ cash prices for the 2023 crop). November 2023 soybeans have traded $12.50 to $13.50 recently, putting cash soybeans for fall 2023 in the $12.00 to $13.00 range. These prices are below the highs for 2023 seen in early June as the “inflation” trade in commodities began to subside, but recently regained some of this with the lower yields indicated by the Pro Farmer tour.

The increase in land and non-land costs have increased breakeven costs considerably for both corn and soybeans. Projected breakeven for corn for 2023 are at $5.00 to $5.50+ per bushel and breakeven for soybeans at $13.00 or better in many cases. With higher breakeven, risk levels have increased for farm operators.

These factors, plus others, are constantly evaluated when managing a farm and used in our decision making for custom, crop-share, and cash rent agreements. We have spent most of August negotiating leases on the cash rent farms and used this information when determining the appropriate rental level for 2023. For our crop share and custom farms, the research we have conducted recently has caused us to pull the trigger on purchasing fertilizer for the 2023 crop season on some of these farms due to supply concerns in the winter or next spring.

OTHER MACRO FACTORS FOR AGRICULTURE REAL ESTATE VALUES

INTEREST RATES & INFLATION

One question we typically are asked is what is next for Agriculture Real Estate values? Outside of some of the factors we have discussed, other macro factors can impact values moving forward. Particularly, inflationary impacts and the increases in interest rates.

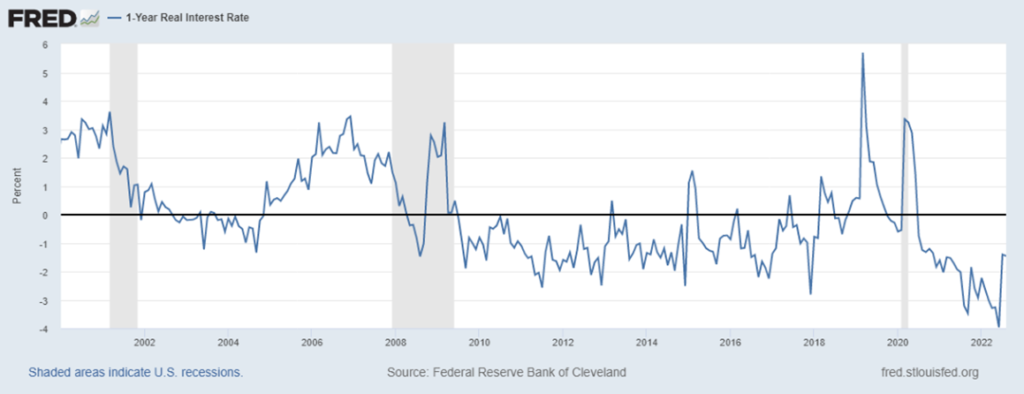

In terms of interest rates, we have seen 30 year mortgage rates increase to around 5.5 % from a low in 2021 of 2.65 %. This is a nominal interest rate and not a real interest rate. A real interest rate factors in inflation by subtracting the expected inflation rate from the nominal interest rate. For example, if your interest rate for a loan is 5.5 % and the expected inflation rate is 7 %, the real interest rate is -1.5 %. If the real interest rate is below zero, the amount you will pay back is less than the money borrowed. Below is a graph outlining the one-year real interest rates, which shows we are still in a negative real interest rate environment. In environments of negative or low real interest rates, which have been in for quite some time, there is a higher incentive to borrow money to invest rather than to save.

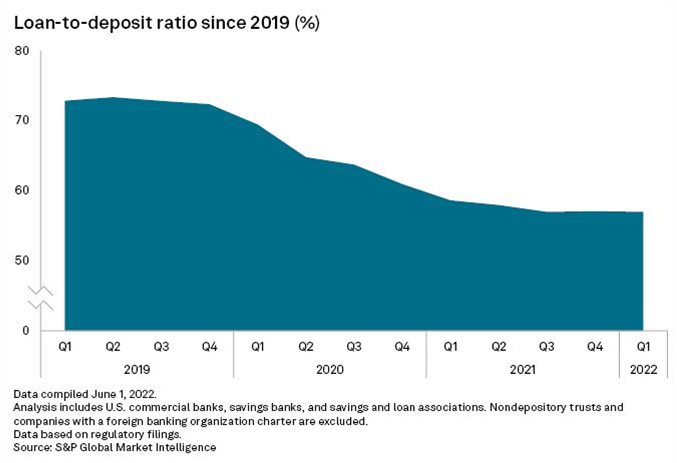

Another factor is the supply of capital for borrowers to invest with and the demand for lenders to make loans. This can be measured by the loan to deposit ratio. A lender loans money based on the amount of deposits it has and makes a profit by the spread between the revenue from the loan and the cost of the deposit. United States banks have historical low loan to deposit ratios at 57 %, which means lenders will be competitive to loan money (see graph below).

So, not only do we have low real interest rates, but lenders will be competitive to loan funds with the deposits they have. Our conclusion is these dynamics have limited the impact of the increases in interest rates to this point.

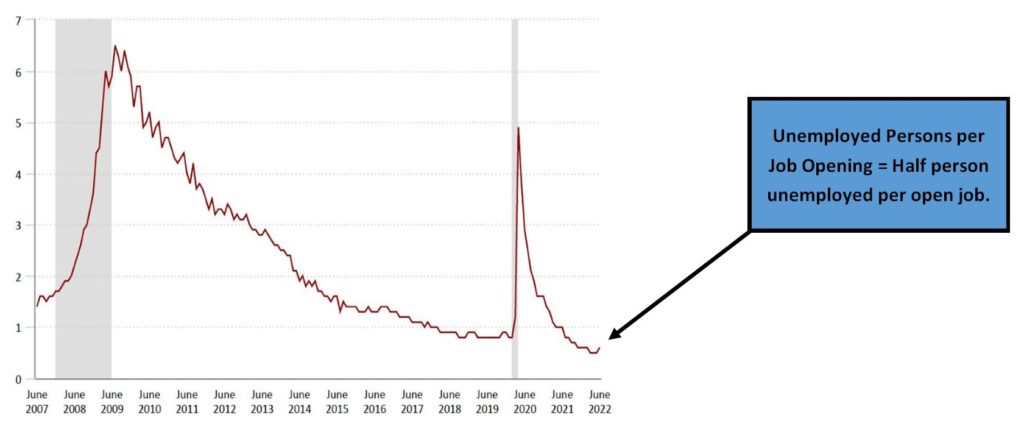

In terms of inflation, the primary question is if this a near or long-term phenomena. The increases in material and labor costs in the last two years has been incredible. We have seen declines in commodity and energy prices since highs set last Spring, which has provided relief recently. One of the primary concerns of inflation is that it becomes self-fulfilling, or consumers expect inflation so it sustains itself even if it could start declining. A major factor that could impact this is the labor market. As of July, we finally reached the same amount of jobs in the United States as we have pre-Covid. We met this number with 2.5 Million less participants in the workforce.

The U. S. Bureau of Labor Statistics calculates the number of Unemployed Persons per Job Opening on a monthly basis. In May 2022, this was as low as 0.5 people unemployed per open job. With this low of a labor participation rate, its hard to envision this not being an inflationary item until something significantly changes.

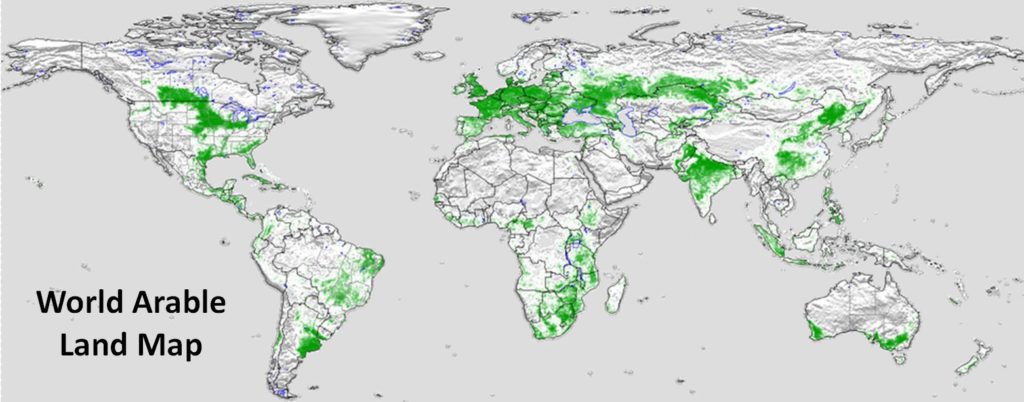

The Midwest has some of the best Arable Land in the world (see below). Combine this with factors described within and we can see why we continue to see strong valuations for Agriculture real estate in Iowa. In conclusion, Agriculture Real Estate continues to be in strong demand and a good part of one’s portfolio.

Residential Real Estate

Residential Real Estate